A Guide to Breakdown Cover

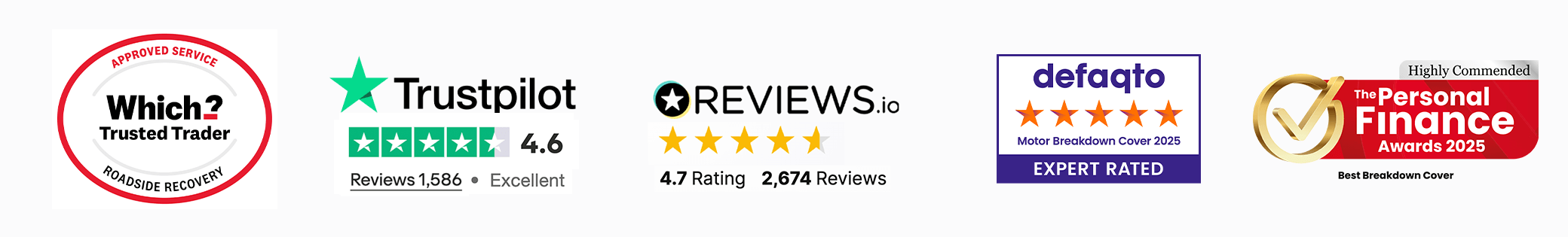

Whilst it’s possible to reduce your risk of breakdown, it’s an unfortunate reality that even the most expertly maintained and superbly driven vehicle may break down due to unforeseen circumstances. In these cases, having reliable breakdown cover can be essential, ensuring support in any situation. Choosing a trusted provider like GEM Motoring Assist — highly rated in customer satisfaction —ensures quality assistance when it matters most.

Do I need breakdown cover?

In this article we’ll take a detailed look at why it makes sense to have breakdown cover in place, what kind of cover best suits your needs, including options like personal vs. vehicle coverage and add-ons that cater to specific needs, and how breakdown cover tends to work alongside practical tips for comparing providers. Knowing how to choose a reputable provider not only saves money but ensures that your cover is reliable when needed most.

What is breakdown cover?

Newer drivers may be unfamiliar with the term breakdown cover or may be unaware of exactly what it entails. In a nutshell, breakdown cover ensures that, should your vehicle break down while you are on the road, you can call upon your roadside assistance provider to be rescued and repaired promptly.

There are different kinds of cover available and, depending on the circumstances and the level of cover you have in place, you could be repaired at the roadside, taken to a nearby garage, or transported to your chosen destination. This peace of mind is invaluable, especially with providers that offer 24/7 customer support.

Why get breakdown cover?

So, why get breakdown cover? Perhaps a more worthy question is, why wouldn’t you get breakdown cover? While most drivers are sure to protect themselves with breakdown cover, there are many who don’t because they are labouring under one of several common misapprehensions:

- They mistakenly believe their car insurance already includes roadside assistance, when not all standard policies offer it

- They feel confident their car won’t break down, especially if they are careful drivers or have a newer vehicle

- They invest in regular maintenance and believe this prevents any risk of breakdown

- They worry that breakdown cover will be too costly, without fully understanding the financial benefits and savings it can offer.

While understandable, none of these beliefs can protect you if you break down on an unfamiliar road. In fact, breakdown cover not only saves on immediate costs but can prevent major expenses and inconveniences.

Protecting against the unpredictable

Every driver hopes they won’t need roadside assistance, but breakdowns can happen to anyone, even with the most reliable vehicles. Having breakdown cover ensures you’re prepared, regardless of the situation.

What’s more, the monthly expense for breakdown cover is usually low, especially when compared to the potential costs of roadside repairs or towing without it. With a reputable provider like GEM, you get high-quality support without hidden fees, which enhances long-term savings and peace of mind.

If you break down without breakdown cover

If you break down without cover, the cost can be surprisingly high. The cost of getting your vehicle collected and towed to a garage alone could be substantial, and any on-the-spot repairs a technician would have to make to your vehicle often come with a premium charge. That’s why breakdown cover is considered essential by drivers across the UK.

Even if you break down near a garage, there’s no guarantee they’ll be able to inspect your vehicle right away, and repair costs can quickly add up. A breakdown technician can ensure that you get home or to your destination, saving you time and stress.

Peace of mind

If you’re planning a long trip or travelling through unfamiliar areas, breakdown cover offers valuable peace of mind. There’s nothing worse than being stranded in an isolated area at night, or unloading the boot to locate the spare wheel at the roadside.

At best, you’ll need to pay a local towing service to get you to the nearest garage, which can be extremely costly. With breakdown cover, however, you’re not left without support.

If you break down after hours or in a remote location with poor mobile service, finding assistance can be challenging without coverage. With GEM, you can access 24/7 assistance, ensuring that help is just a call away.

So, if you’re planning on going on a long journey, it’s a good idea to ensure you have breakdown cover in place.

Don't leave it to chance

Are you still wondering 'Do I need breakdown cover'? Not only does purchasing breakdown cover save you money in the long run, it also ensures that you can drive locally and further afield with peace of mind.

If you’re ever in any doubt as to whether or not you should get breakdown cover, simply take a moment to consider the alternative.

What type of breakdown cover do I need?

With so many different policies on the market, it can be difficult to know which best suits your needs. Of course, nobody can make this decision for you, but there are several factors you should consider when choosing breakdown cover including:

- The age and general condition of your car

- How many people drive your vehicle

- What other vehicles you drive e.g your partner’s car, a company car or a motorcycle

- Where and how often you tend to drive

- Whether or not you take your car overseas i.e. to Ireland or Europe

Some policies will charge you an annual fee which will entitle you to a certain number of callouts per year but these may not be appropriate if your vehicle breaks down often, so a policy with unlimited callouts would be a better option.

Personal vs vehicle breakdown cover

You can choose to either get personal cover to cover yourself for any vehicle you happen to be driving, or cover for the vehicle regardless of who is driving it. Obviously, which cover is best for you will depend on your needs and circumstances.

Vehicle cover tends to be more affordable, while personal cover offers you greater flexibility and convenience if there is more than one vehicle in the household and you tend to drive more than one regularly, this can even include hire cars. As with insurance, you can sometimes save money by buying a multi-car breakdown policy with a provider.

Whether you buy personal or vehicle breakdown cover, different providers have different accommodations and provisions. Some offer more comprehensive protection, while others may be fundamentally unsuited to your vehicle or circumstances, which brings us to…

What’s included?

Did you know that some breakdown cover providers will charge you more for an older vehicle, or won’t cover vehicles over a certain age at all? Or that some won’t come out to you if your battery runs flat or you happen to put the wrong fuel in your vehicle? Or that some will charge you a premium or may not even come out at all if you break down half a mile from your home.

Different providers tend to package their services under different names with different levels of cover, which is why it’s hard to comprehensively detail what is included in breakdown cover.

Roadside cover

Typically, roadside cover or its equivalent is the most basic form of cover and will get you a roadside repair or tow to your nearest local garage where it isn't possible to fix your car with a roadside repair.

Nationwide cover

The next step up is some sort of national cover where, if roadside or local repair is not possible, a technician will facilitate onward transportation to your home or your preferred destination.

Home cover

Some may also offer a home-start policy or provide home-start as an add-on, which ensures that your vehicle is still covered by home breakdown cover, if you break down close to home or even discover a flat battery on your own drive.

Onward travel

Providers may have onward travel cover automatically included, or listed as an optional extra, whereby the cost of unexpected accommodation like a hotel stay, or the hiring of a rental car, is included in the cover. If you use your car for business, you will likely need specific business breakdown cover, which can cover an individual vehicle or a fleet.

Parts and garage cover

Some policies also include parts and garage cover which covers the cost (or part thereof) of a repair when a trip to a garage is needed. In the case of business vehicles, however, such as taxis and limousines, this tends not to be applicable.

European breakdown cover

You can also get additional cover for driving throughout Europe. Let’s face it, the thought of breaking down in an unfamiliar town is scary enough, much less an unfamiliar town where you only speak a smattering of the local language and have to ask passers-by where you can find the nearest garage through the medium of wild hand gestures.

How does breakdown cover work?

In principle, breakdown cover is pretty straightforward. Once you have an active personal or vehicle breakdown policy, you can drive safe in the knowledge that your car has the appropriate breakdown cover for your specific needs.

In the event of a breakdown you will be given a number to ring, or some providers have a companion app. When you break down use the app or call your provider and they will usually have a technician out to you within an hour or so, although this may vary depending on your location and provider, as well as traffic and weather conditions.

As with insurance it may not always be the best idea to auto renew your policy. Keep an eye on the market and what breakdown cover policies are available. In most cases you can change or make additions to your breakdown cover without waiting for it to renew.

Comparing prices

Of course, as with all things, consumers need to assure themselves that they’re getting the best breakdown cover and the best possible value for money with their car breakdown cover.

Nobody wants to pay over the odds for basic cover and likewise nobody wants to pay for extras that they’ll likely never use. Equally, you don't want to be caught short if you've taken out the cheapest breakdown cover which, it turns out, doesn't include the cover you need.

So, it’s essential to compare breakdown cover and understand the different policies available, to ensure that you’re getting the cover you need at a price that suits you.

Even if you've been given free breakdown cover with an insurance policy or bank account, it's a good idea to check exactly what is included by reading through your policy documents.

Simple and straightforward breakdown cover from GEM Motoring Assist

Fortunately, GEM’s all-inclusive breakdown cover spares you a lot of the legwork. Our award-winning personal breakdown cover automatically includes home and roadside assistance, nationwide recovery and onward travel. No add-ons or catches… just all-inclusive breakdown cover.

We have two types of cover:

Recovery RECLAIM– Our ‘pay and claim’ package. Select this if you are happy to arrange your vehicle recovery, pay the callout and labour charges yourself, and reclaim these from us later. Many of our customers who choose this option have their own preferred garage or mechanic. You can also call us for help, but you will still need to pay the costs and then claim them back.

Recovery EXTRA – This is our premium and most popular breakdown service package. We organise everything including callout fees and labour charges.

All of our cover includes unlimited call-outs, so you don't have to worry about how many times you request our help within your annual policy year.

So, how do these stack up against our competitors?

Compare our cover to a a similar product from the AA or the RAC and you can save on your premium. Compare our breakdown cover prices here.

Moreover, if you select our Recovery RECLAIM package you can reduce your up front costs, and you won’t find an equivalent product elsewhere as it’s exclusive to GEM!

Needless to say you’ll still get the great cover you’d expect including home assistance, help with onward travel and accommodation, cover for vehicles of any age and unlimited callouts.

So, the simple question is… why pay more?